|

|

| 1. |

Short title

This Act may be cited as the Widows’ and Orphans’ Pensions Act.

|

| 2. |

Interpretation

| (1) |

In this Act, except where inconsistent with the context—

“approved scheme” means a scheme or fund for the granting of pensions to the widows and children of officers in the public service, which has been declared to be an approved scheme for the purposes of this Act;

“beneficiary” means—

| (a) |

the widow of a contributor;

|

| (b) |

the children of a contributor, by his marriage with any wife dying in his lifetime, who are alive and of a pensionable age at the death of their father;

|

“contributor” means a contributor to the scheme, and includes a person who has ceased to contribute in such circumstances that he continues to rank for benefit under this Act;

“East African Service” means the service of the Government of any one or more of the following: Kenya, Uganda, Nyasaland, Zanzibar, Somalia, Northern Rhodesia, Tanganyika and the Community; which Governments are referred to as East African Governments;

“European officer” means any officer both of whose parents were of European descent (but includes also any other officer who is appointed under the conditions of service ordinarily applicable to Europeans);

“this Government” means the Government of Kenya, and shall be deemed to include the Community;

“of a pensionable age” as applied to children means, in the case of a male, that he is under the age of twenty-one years and, in the case of a female, that she is under the age of twenty-one years* and has not been married; a child shall be deemed to cease to be of a pensionable age within the meaning of this Act, if a male, on attaining the age of twenty-one years* or dying under that age, and, if a female, on attaining the age of twenty-one years, or dying or marrying under that age:

Provided that a child who has ceased to be of pensionable age and is, in the opinion of the President, by reason of infirmity of mind or body, incapable

__________________________________

*Formerly eighteen years: see Act No. 25 of 1945.

of earning a livelihood and without sufficient means of support shall be deemed, for the purposes of this Act, to continue to be of pensionable age for such period as the Act may determine;

“other public service” means public service not under the Government of Kenya;

“President” includes, where the context so admits or requires, the Community;

“public service” means—

| (a) |

service in a civil capacity under the Government or under the government of any other country or territory in the Commonwealth;

|

| (b) |

service under the East Africa High Commission, the East African Common Services Organization, the East African Railways and Harbours Administration or the East African Posts and Telecommunications Administration;

|

| (c) |

service which is pensionable—

| (i) |

under the Oversea Superannuation Scheme;

|

| (ii) |

under any Acts relating to the superannuation of teachers in the United Kingdom;

|

| (iii) |

under a local authority in the United Kingdom; or

|

| (iv) |

under the National Health Service of the United Kingdom;

|

|

| (d) |

service as President, Vice-President, Justice of Appeal, Registrar, officer or servant of Her Majesty’s Court of Appeal for Eastern Africa established by the Eastern Africa Court of Appeal Order in Council, 1961 (L.N. 680/1961);

|

| (e) |

service in the service of the Interim Commissioner for the West Indies; and

|

| (f) |

any other service which the President determines to be public service for the purposes of this Act;

|

“the scheme” means the scheme common to Kenya, Uganda, Tanganyika and Zanzibar for granting pensions to the widows and children of European officers in the East African Service which it is intended to establish by this Act and by similar legislation in Kenya, Uganda, Tanganyika and Zanzibar.

|

| (2) |

When the marriage of any contributor has been annulled or dissolved by the decree of any competent court, the wife party to such marriage shall for all purposes of this Act be deemed to have died and the contributor to have become a widower at the date of such decree.

|

|

| 3. |

Who shall become contributors

| (1) |

Subject to the exceptions mentioned in section 5 of this Act, every European officer appointed permanently or temporarily to a post in the service of this Government after, and not appointed or selected for appointment to the East African Service on or before, the 1st April, 1921, shall become a contributor under this Act from the date on which he commences to draw any of the salary of the post.

|

| (2) |

Subject to the same exceptions, any European officer in the service of the Government who was in, or selected for appointment to, the East African Service on the 1st April, 1921, and who has not since become a contributor, may apply to this Government for special permission to become a contributor, and if after the examination of the officer by a Government medical board the President in his discretion decides that such permission should be granted, the officer shall contribute as from the first day of the month next after that in which the President’s decision is notified to him.

|

| (3) |

| (3) |

(a) If a European officer who was in, or selected for appointment to, the East African Service on the 1st April, 1921, elects to become a contributor and is appointed to the service of this Government subsequently to such election, he shall contribute under this Act.

|

| (b) |

If such an officer does not elect to contribute to the scheme and is appointed to the service of this Government subsequently to the 1st April, 1921, upon such terms as constitute a re-appointment to or re-engagement in the East African Service, he shall, for the purposes of this Act, be deemed to be appointed to the service of this Government on the date of such re-appointment or re-engagement.

|

|

|

| (4) |

Any officer who has claimed exemption from the obligation to become a contributor under this Act under paragraph (a) of subsection (4) of section 5 of this Act, and who subsequently becomes ineligible to continue to be a depositor to the East African Railways and Harbours Administration Provident Fund, shall become a contributor under this Act from the date on which he ceases to be a depositor in the said Fund, unless he is otherwise ineligible or not liable to do so.

|

| (5) |

Any officer who has claimed exemption from the obligation to become a contributor under this Act under section 4 of this Act and who subsequently becomes ineligible to continue as a contributor to the Oversea Superannuation Scheme shall become a contributor under this Act from the date on which he ceases to be a contributor in the said Scheme, unless he is otherwise ineligible or not liable to do so. [Act No. 9 of 1960, s. 2.]

|

| 4. |

Exemption in case of contributor to Oversea Superannuation

Scheme

| (1) |

Any officer who is or becomes a contributor to the Oversea Superannuation Scheme may claim exemption from the obligation to become or to continue to be a contributor under this Act; every such claim shall be made in writing and shall be received by the Accounting Officer of his Ministry or Department or by the Crown Agents within three months from the date upon which such officer first became a contributor to the said Scheme.

|

| (2) |

Every such claim for exemption shall take effect from the date upon which the officer first became a contributor to the Oversea Superannuation Scheme, and the amount of any contributions which he has made under this Act since that date shall be refunded to him without interest.

|

| (3) |

As from the date upon which any such claim to exemption takes effect, the officer by whom the claim was made shall be deemed, in respect of all rights arising from his contributions made under this Act before that date, to be subject to the provisions of sections 33, 36 and 39 of this Act to the same extent as if he had left the East African Service on that date. [Act No. 9 of 1960, s. 3.]

|

|

| 5. |

Who shall not be contributors

| (1) |

The following shall not be eligible to be contributors—

| (a) |

Presidents and their private secretaries and aides-de-camp, if not contributors before they held those positions or holders of substantive appointments entitling them to be contributors;

|

| (b) |

officers, non-commissioned officers and men on the active list of the Royal Navy, the Regular Army or the Royal Air Force temporarily employed by an East African Government in either a military or a civil capacity and not holding pensionable appointments under this Government;

|

| (c) |

persons in the service of this Government by reason only of their membership of any Naval, Military or Air Force constituted by local legislation in force in Kenya;

|

| (d) |

persons temporarily employed on special missions;

|

| (f) |

persons whose engagement not being for a specific period is terminable at one month’s notice or less;

|

| (g) |

persons who are unmarried and are at the time of employment under the age of twenty-one years:

|

|

Provided that, if they are otherwise liable to contribute under the terms of this Act, they shall, on becoming married or on reaching the age of twenty-one, forthwith become contributors;

|

| (h) |

persons who are contributors to the East African Railways and Harbours Administration Superannuation Fund, other than those persons who at the date of commencement of their membership of the Superannuation Fund were contributors under this Act, and all persons appointed permanently or temporarily to the service of the East African Railways and Harbours Administration on or after the 1st day of January, 1955;

|

| (i) |

contributors to the Oversea Superannuation Scheme for so long as they are required to contribute thereto, unless already contributing under this Act;

|

| (j) |

any person serving under a written agreement expressed to continue for a specified period or periods if—

| (i) |

such person is appointed on or after a day determined by the President, by notice in the Gazette, for the purposes of this paragraph, unless the terms of his appointment provide that he shall be eligible to be a contributor; or |

| (ii) |

such person was appointed before the day determined under subparagraph (i) of this paragraph, and elects, by written notice addressed to the Accounting Officer of his Ministry or Department or to the Crown Agents and, unless the President is of the opinion that in the particular circumstances of the case the notice should be accepted at a later date, received by either of them within three months of that day, not to continue to contribute, in which case that person shall cease to be a contributor (in so far as that expression means a contributor to the scheme) with effect from the first day of the month after that in which such notice is received by the accounting officer or the Crown Agents. |

|

|

| (2) |

The following shall not be eligible to become contributors, namely, persons who have attained the age of forty-nine, unless they are transferred from other East African Service in which they were contributors under the scheme and have not completed their periods of contribution.

|

| (3) |

| (3) |

(a) if his contributions are limited to £60 per annum, he may at any time, by written notice to the Accounting Officer of his Ministry or Department or to the Crown Agents, elect to resume the rate of contributions provided for in paragraph (a) of subsection (1) of the said section 7 at the point he would have reached had his contributions not been so limited, or elect to contribute at any fixed rate being a multiple of £5 per annum and not being lower than £60 per annum, not exceeding the point he would have reached as aforesaid;

|

| (b) |

If an officer who is a contributor under an approved scheme, and who before the 1st January, 1944, has been exempted under the Act then in force from becoming a contributor under this Act, marries after that date, he may at his option become a contributor under this Act notwithstanding that he continues to contribute to such approved scheme.

|

| (c) |

The President may require any officer who has been granted an exemption under this subsection from time to time to produce the receipts for his contributions or other evidence of his continuing to be a contributor under such approved scheme, and if he fails to do so the President may cancel the exemption.

|

| (d) |

No application by an officer for exemption under this subsection shall be valid unless it is made in writing and reaches the President not later than three months after the date from which such officer commences to draw salary from the funds of Kenya, or such later date as the President may in any special case determine.

|

| (e) |

Where an officer is, by virtue of an exemption under this subsection, making no contributions under this Act, he shall nevertheless be deemed, for the purposes of this Act, to cease or to continue to contribute, as the case may be, in any circumstances in which he would so cease or continue if such exemption had not been granted, and all rights of election under sections 33, 34, 36, 37 and 39 of this Act may be exercised by him accordingly.

|

|

| (4) |

| (4) |

(a) if his contributions are limited to £60 per annum, he may at any time, by written notice to the Accounting Officer of his Ministry or Department or to the Crown Agents, elect to resume the rate of contributions provided for in paragraph (a) of subsection (1) of the said section 7 at the point he would have reached had his contributions not been so limited, or elect to contribute at any fixed rate being a multiple of £5 per annum and not being lower than £60 per annum, not exceeding the point he would have reached as aforesaid;

|

| (b) |

Every such claim for exemption shall take effect from the date upon which the officer first became a depositor to the said Fund, and the amount of any contributions which he has made under this Act since that date shall be refunded to him without interest.

|

| (c) |

As from the date upon which any such claim to exemption takes effect, the officer by whom the claim was made shall be deemed, in respect of all rights arising from his contributions made under this Act before that date, to be subject to the provisions of sections 33, 36 and 39 of this Act to the same extent as if he had left the East African Service on that date.

|

| (d) |

For the purposes of this subsection, an officer who had previously been a depositor in the said Fund and had ceased to be a depositor but who again becomes a depositor by reason of his re-appointment to the service of the Community shall have the same rights as though the date upon which he again becomes a depositor were the date upon which he became a depositor for the first time.

|

| (e) |

Save as provided in subsection (4) of section 3 of this Act, an officer who has claimed exemption under this subsection may not subsequently become a contributor under this Act unless he marries and gives notice to the Government not later than three months after the date of his marriage that he desires so to become a contributor, and satisfies the President, by submitting to such medical examination as the President may require, or otherwise, that he is in good health.

|

|

| (5) |

Where an officer ceases to contribute under subsection (1)(j)(ii) of this section, sections 33 and 39 of this Act shall apply to him as if he had left the East African Service on the date on which he so ceased to be a contributor.

|

|

| 6. |

Officers in services common to more than one East African

Government

| (1) |

The President may from time to time by notice declare that, notwithstanding the provisions of this Act, the posts specified in the notice, being posts of which the salaries are provided wholly or partly by more than one East African Government shall be deemed for the purpose of this Act to be either—

| (a) |

posts in the service of Kenya; or

|

| (b) |

posts not in the service of Kenya.

|

|

| (2) |

The provisions of subsection (3) of section 7 of this Act shall not apply to any officer holding a post so declared to be in the service of Kenya, who shall for the purposes of subsection (1) of that section be deemed to be in receipt of salary from the funds of Kenya equal to the total salary of the post from whatever source it is drawn.

|

| (3) |

Any notice issued under this section shall have retrospective effect as regards any post to the date from which the holder for the time being thereof entered the East African Service.

|

| (4) |

If the holder of any post declared by notice under this section to be in the service of Kenya has not been required prior to the notice to contribute to the scheme, he may, within three months of the date on which the notice concerning his post is issued or such later date as the President may in any special case allow, elect to be exempted either from the requirement to contribute thereto or from his

liability to make contributions in respect of service prior to the date upon which the notice is issued; the date of the election shall be deemed to be the date of the receipt of the written notification addressed either to the Minister in Kenya or to the Crown Agents; and any election duly exercised shall be irrevocable.

|

|

| 7. |

Rates of contribution

| (1) |

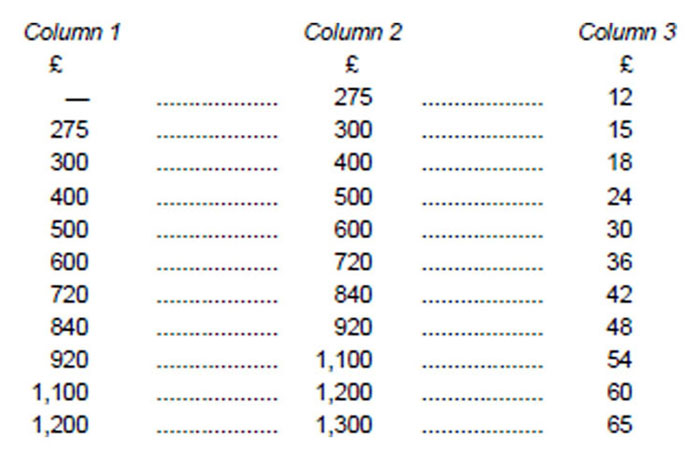

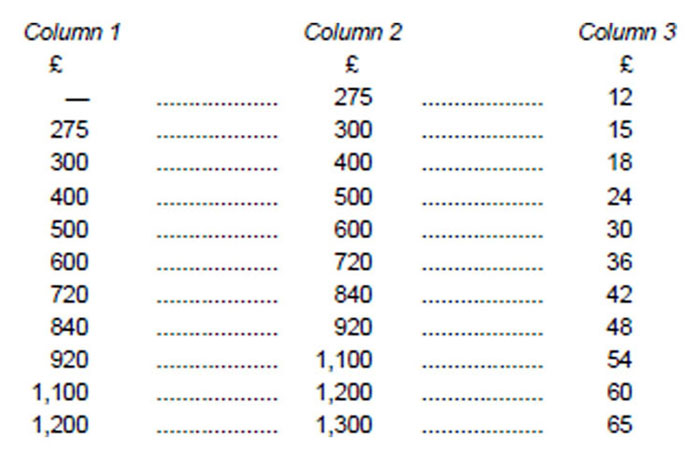

The rates of contribution shall be as follows—

| (a) |

an officer whose salary exceeds the amount given in any line of the first column below but does not exceed that given in the corresponding line of the second column shall contribute at the annual rate given in the corresponding line of the third column—

and so on, the annual contribution increasing by £5 for each step of £100 in the salary scale;

|

| (b) |

| (i) |

a contributor who before the date of his first payment of contribution under this Act or within three months after marrying by written notice to the Crown Agents so elects may make an additional annual contribution of one-half of the amount specified in the line of column 3 above which is applicable to him at the date of notification, or, if he so decides at the date of notification, of one-half the amount so specified which is applicable to him from time to time; |

| (ii) |

a contributor who has not so elected before the date of his first contribution or within three months after marrying may be permitted so to elect at any time during his contribution term, subject to the approval of the President after examination by a Government medical board; and if he so elects to make an additional annual contribution he shall make it accordingly as from the date on which he first became an contributor or as from the first day of the month next after that in which his notice was received by the Crown Agents or as from the first day of the month next after that in which the President’s approval was given to his subsequent election, as the case may be; |

| (iii) |

a contributor who on the 1st January, 1926, was making an additional annual contribution and has not since discontinued it may, if he so elects before the 1st August, 1927, discontinue it with effect from the 1st January, 1926, or he may elect to make his annual contribution at one or the other of the above rates with effect either from the first day of the month next after that in which his notice was received by the Crown Agents, or, if he prefers it and so elects before the 1st August, 1927, with retrospective effect from the 1st January, 1926; |

| (iv) |

a contributor who at the time of his appointment or reappointment to the service of this Government is already making an additional annual contribution under the scheme shall (unless he elects at any time under subsection (1) of section 10 of this Act to discontinue such additional contribution) continue to pay it as an additional annual contribution under this Act; and an officer who has ceased to contribute under the scheme may on being re-appointed to the service of this Government elect to make an additional annual contribution at the rate then applicable to him from time to time; no officer shall be allowed to make more than one additional annual contribution under the scheme at the same time; |

|

| (c) |

no officer shall be required to contribute at a higher rate than £60 a year;

|

| (d) |

no officer shall, after attaining the age of forty-nine years, contribute at a higher rate than that at which he was contributing immediately before attaining that age;

|

| (e) |

the provisions of paragraph (b) of this subsection shall not apply to any officer who becomes a contributor after the 1st January, 1944.

|

|

| (2) |

A European officer who is in the service of this Government on the 1st April, 1921, and who elects to become a contributor may, if he wishes, when so electing pay to the Crown Agents as a lump sum contribution an amount not exceeding the total without interest of the amounts which he might have contributed by way of annual and additional annual contributions prior to the date of commencement of his contribution if this scheme had come into operation on the 1st April, 1916.

|

| (3) |

Where a contributor is in receipt of salary from more than one East African Government, his contributions under this Act shall bear the same proportion to the contributions which he would have paid under this Act had the whole of such salary been payable by this Government as the salary in fact payable by his Government bears to his total salary.

|

|

| 8. |

Power to vary rate of contribution

Notwithstanding the provisions of paragraph (a) of subsection (1) of section 7 of this Act, an officer who is contributing at a rate of not less than £60 a year may vary his future contributions as follows—

| (a) |

if he is contributing at a rate higher than £60 a year, he may at any time, by written notice to the Accounting Officer of his Ministry or Department or to the Crown Agents, elect that his future annual contributions shall be at any fixed rate, being a multiple of £5 per annum and not being above the rate applicable to his salary in accordance with paragraph (a) of sub section (1) of the said section 7 and not being lower than £60 per annum, as he shall specify:

Provided that no officer may elect more than once to decrease his future annual contributions;

|

| (b) |

| (i) |

if his contributions are limited to £60 per annum, he may at any time, by written notice to the Accounting Officer of his Ministry or Department or to the Crown Agents, elect to resume the rate of contributions provided for in paragraph (a) of subsection (1) of the said section 7 at the point he would have reached had his contributions not been so limited, or elect to contribute at any fixed rate being a multiple of £5 per annum and not being lower than £60 per annum, not exceeding the point he would have reached as aforesaid; |

| (ii) |

an officer electing in accordance with subparagraph (i) of this paragraph shall thereafter be deemed to be an officer to whom paragraph (a) of this section applies; |

|

| (c) |

any election provided for in paragraphs (a) and (b) of this section shall—

| (i) |

take effect as from the beginning of the month immediately following that in which his notification is received by the said Accounting Officer or the Crown Agents; |

| (ii) |

be invalid if it is received by the said Accounting Officer or the Crown Agents within two years after the receipt of any previous such election; |

| (iii) |

be invalid if it is made by an officer who has retired on pension from the East African Service; |

| (iv) |

in the case of an officer electing to increase his contributions, be accompanied by a recent certificate of physical fitness signed by a medical officer, or by a medical practitioner approved for the purpose by the Government. |

|

| (d) |

for the purpose of all the preceding paragraphs of this section, no regard shall be had to any additional contribution made under paragraph (b) of subsection (1) of section 7 of this Act.

|

|

| 9. |

Salary only to determine rates of contribution

For the purpose of fixing the rate of contribution, no regard shall be had to any personal, duty or acting allowance, nor to any other receipts, emoluments or advantages of any kind which the officer may receive or enjoy; but the contribution shall be assessed with regard only to the amount of the salary, including overseas addition or personal inducement allowance, of the definite post held by the officer without previous deduction of the amount of his contributions.

|

| 10. |

Period and manner of contribution

| (1) |

| (1) |

(a) All annual contributions shall be paid in monthly instalments and shall, subject as hereunder mentioned, be payable until either the contributor dies or he has contributed for an exact number of years, such period of payment in the latter case terminating on or after the forty-ninth and before the fiftieth birthday of the contributor:.

Provided that a contributor who is making an additional annual contribution may at any time, by notification to the Crown Agents, elect to discontinue such contribution either as from the next date subsequent to the receipt of his notification of election by the Crown Agents on which the installments paid on account thereof will amount to one or more full annual contributions, so as from the beginning of the month next after that in which his notification of election is received by the Crown Agents

|

| (b) |

When a contributor so elects to discontinue an additional annual contribution, only such instalments thereof as form part of a complete annual contribution paid by him shall be taken into account for the purpose of calculating any pension under this Act, and any balance shall not be refunded except in pursuance of the provisions of section 33 of this Act.

|

|

|

| (2) |

(a) The Crown Agents shall deduct the contributions from the salaries of contributors when they are on leave, or when their salaries are wholly paid through the Crown Agents or from the pensions of contributors who retire on pension and elect to contribute under this Act and whose pensions are payable through the Crown Agents.

|

| (b) |

When a contributor’s salary or pension is not wholly paid through the Crown Agents, his contributions shall be deducted from his salary or pension as the case may be by the Government.

|

| (c) |

If a contributor is on leave on half salary or under interdiction, or on leave without salary, he shall still be liable to contribute at the ordinary rate; and in such case, if the contributor does not himself pay to the Government his contributions during the period when he was on leave without salary, the amount of his contributions in arrear shall be deducted from the first payment of salary after such leave.

|

|

|

| 11. |

Officers from Palestine may become contributors

Notwithstanding anything contained in this Act, any officer who was a contributor under the Widows’ and Orphans’ Pensions Act, 1944, of Palestine immediately before the termination of His Majesty’s jurisdiction in Palestine, and who is transferred to the service of the Government of Kenya, may become a contributor if, not later than three months after such transfer or after the 25th August, 1948, whichever is the later, such officer makes a lump sum payment under the provisions of this Act, equal to the accumulated contributions he has paid under such Palestine Act. [Act No. 11 of 1949, s. 2.]

|

| 12. |

Lump sum payable by contributors transferred from Cyprus

| (1) |

A contributor under this Act who was a contributor to the fund established under the Widow’s and Orphans’ Pensions Law of Cyprus before the 1st January, 1960, and to whom there was paid under the Widows’ and Orphans’ Pensions (Special Provisions) Law, 1960, of Cyprus an amount representing his interest in that fund as at the 31st December, 1959, may, if he is an officer who has been transferred from the service of the Government of Cyprus to the service of this Government, pay to the Treasury of Kenya a sum equal to the said amount.

|

| (2) |

A sum paid by a contributor under subsection (1) of this section into the Treasury shall be paid before the 1st September, 1961, or within three months of the date of his transfer, whichever is the later, or by such later date as the President may in any special case allow, and the pension payable in respect of such contribution shall be increased by such amount as the President, on the advice of an actuary approved by him, may determine.

|

|

| 13. |

How contributions to be brought to account

All contributions under this Act shall be paid into, or credited by the Crown Agents to, the Treasury of Kenya or the funds of the Community, as the case may be.

|

| 14. |

Registers of contributors to be kept

Registers shall be kept by the Crown Agents, in which shall be entered the date of the birth of every contributor and, if he is married, the dates of the births of his wife and children (if any), particulars of his contributions, and all other dates and particulars respecting contributors and their families material to be recorded for the purposes of this Act.

|

| 15. |

Information to be furnished by contributors and widows

| (1) |

Every contributor shall within three months of his first becoming a contributor under the scheme notify to the Crown Agents in writing—

| (a) |

the date of his birth; and

|

| (b) |

if he is married man, or a widower with children of a pensionable age, the dates of his marriage and of the births of his wife and children (if any).

|

|

| (2) |

Every contributor who marries while a contributor shall within three months after his marriage notify the same to the Crown Agents in writing and state the date of the birth of his wife.

|

| (3) |

Every contributor shall notify to the Crown Agents in writing within three months from the date of the event—

| (a) |

the birth of any child born to him or the adoption of a child by him;

|

| (b) |

the marriage of any female child under the age of twenty-one;

|

| (c) |

the death of his wife and the death or adoption of any of his children of a pensionable age.

|

|

| (4) |

After the death of any married contributor, the widow of such contributor shall notify to the Crown Agents in writing within three months from the date of the event—

| (a) |

the date of the death of the contributor, if he was not at the time in the East African Service;

|

| (b) |

the birth of any posthumous child born to such contributor;

|

| (c) |

the marriage of any female child of such contributor under the age of twenty-one years;

|

| (d) |

the death or adoption of any child of such contributor while of a pensionable age;

|

| (e) |

her own re-marriage or bankruptcy.

|

|

| (5) |

Any such statement or notice shall be proved by the production of birth, death or marriage certificates or by affidavit or otherwise, to the satisfaction of the Crown Agents. [Act No. 9 of 1960, s. 6.]

|

|

| 16. |

Penalty for non-compliance or false statement

| (1) |

A contributor or widow who fails or neglects to comply with any of the requirements of section 15 of this Act shall, for each default, be liable, at the discretion of the President, to pay a sum not exceeding two pounds sterling, which may be deducted from his or her salary or pension as the case may be.

|

| (2) |

If a contributor or widow of a contributor has at any time wilfully made any false statement respecting any of the particulars required by this Act or by any rules or regulations made thereunder to be furnished, all or any part of the rights under the scheme of the contributor or the widow or any child of the contributor shall be liable to be forfeited at the discretion of the President.

|

|

| 17. |

Pension when officer with beneficiaries dies

Upon the death of a contributor who is married or a widower with children of a pensionable age, the full pension registered in his name shall be payable subject to the other provisions of this Act.

|

| 18. |

Calculation of pensions and mode of charge

The Crown Agents shall calculate the pensions payable under this Act and shall pay the pensions as they become due; and they shall charge the sums so paid as well as any refunds of contributions made in accordance with this Act as follows—

| (a) |

where the whole of the officer’s contributions under the scheme has been received by this Government, the whole cost of pensions or refunds in respect of that contributor shall be charged to this Government;

|

| (b) |

where the officer’s contributions under the scheme have been received partly by this Government and partly by one or more other East African Governments—

| (i) |

the amount of pension to be charged to this Government in respect of that officer shall be the amount attributable to the contributions received by this Government in respect of him and calculated in accordance with the tables applicable to that officer; and |

| (ii) |

the amount to be charged to this Government on account of any refund made to or in respect of that officer shall be the total amount of the contributions received by this Government in respect of him, together with any interest thereon, calculated as prescribed by this Act. [Act No. 9 of 1960, s. 8.] |

|

|

| 19. |

Pensions to beneficiaries

Subject to the provisions of this Act—

| (a) |

on the death of a contributor leaving one or more beneficiaries, such beneficiary or each of such beneficiaries shall receive a pension calculated according to the pension tables and instructions set forth in Schedules A and B to this Act;

|

| (b) |

if the pensions are payable to more than one beneficiary, each beneficiary shall receive such a proportion of the pension which it would have received if it had been the only beneficiary as unity bears to the total number of beneficiaries;

|

| (c) |

where there are more beneficiaries than one receiving pensions in respect of the same contributor and any of such beneficiaries ceases to exist within the meaning of this Act, the beneficiary or beneficiaries if more than one remaining in existence shall, or each of them shall, as from the date of such cessation receive the pension it would have received if it and the other beneficiary or beneficiaries (if any) remaining in existence had been the only beneficiary or beneficiaries in existence at the death of such contributor.

|

|

| 20. |

Pension to widow

| (1) |

Where a beneficiary consists of the widow of a contributor, the pension payable to such beneficiary shall, subject to any deductions in respect of partial forfeitures under subsection (2) of section 16 of this Act, be paid to her, and shall cease on her death, bankruptcy or remarriage or on the forfeiture of the whole of such pension in accordance with the provisions of that subsection.

|

| (2) |

If on such pension ceasing as aforesaid there are no children of the marriage of such widow with the contributor living and of pensionable age, such beneficiary shall be deemed to cease to exist and the pension payable to it shall lapse.

|

| (3) |

If on such pension ceasing as aforesaid there are such children living and of pensionable age, such pension shall be continued and paid to such children as hereinafter provided, and such children shall be deemed to constitute a beneficiary within the meaning of this Act.

|

| (4) |

A widow whose pension has on her remarriage lapsed or become payable to the children of her marriage with the contributor who are living and of pensionable age—

| (a) |

may, if her husband dies in her lifetime, be paid the pension which was payable to her before her remarriage—

| (i) |

as from the date of the death of her husband or |

| (ii) |

as from the date when such children cease to be of pensionable age, whichever is the later; and |

|

| (b) |

may, if she becomes entitled on the death of her husband, being a contributor, to be paid a pension under this Act, be paid such pension till such children cease to be of pensionable age; and may then, without prejudice to any rights under this Act of the children of her marriage to her husband, be paid in lieu the pension which was payable to her before her remarriage, if that would be to her advantage.

|

|

| (5) |

In subsection (4) of this section, references to the husband of a widow are references to her husband by any remarriage. [Act No. 9 of 1960, s. 9.]

|

|

| 21. |

Pensions to children

| (1) |

Where a beneficiary consists of children of a contributor, the pension payable to such beneficiary shall be at the same rate as the pension which their mother received or would have received if she had been alive and entitled to a pension, and shall be paid to such children in equal shares while they remain of pensionable age.

|

| (2) |

When any of such children ceases to be of pensionable age, his or her share of such pension shall be paid to the surviving children of pensionable age in equal shares, and when the last surviving child of pensionable age ceases to be of pensionable age such beneficiary shall be deemed to cease to exist and the pension payable to it shall lapse.

|

|

| 22. |

Pensions to adopted children

| (1) |

A child adopted by a contributor while he is married to any wife shall, for the purposes of this Act, be deemed to be the child of the contributor by that marriage if—

| (a) |

the contributor adopted the child before he retired from the public service;

|

| (b) |

the contributor was under the age of fifty-five at the time of the adoption; and

|

| (c) |

the adoption was in accordance with the law of the place where the contributor was resident at the time of the adoption.

|

|

| (2) |

The child of a contributor who is adopted by any other person—

| (a) |

in the lifetime of the contributor, or while a pension is being paid under this Act to the mother of that child, shall be deemed, for the purposes of this Act, to have died at the date of the adoption;

|

| (b) |

after the death of the contributor shall, if he is being paid a pension or a share of a pension under this Act, continue to be paid such pension or such share.

|

|

| (3) |

Nothing in this section shall entitle an adopted child to be paid a pension or a share in any pension where the payment to him of such pension or such share would diminish the pension or the share of any pension immediately payable or being paid at the commencement of this section to the widow or to any child or children by marriage of the contributor. [Act No. 42 of 1956, s. 2, Act No. 9 of 1960, s. 10.]

|

|

| 23. |

Who not entitled to pension

| (1) |

No widow of a contributor whose marriage with him is contracted after he has left the public service (unless he has elected to contribute under section 34 of this Act and at the date of the marriage is so contributing or has ceased to do so by virtue of sub section (1) of section 10 of this Act) or has attained the age of fifty-five and no issue of such marriage shall constitute a beneficiary for the purpose of this Act or become entitled to pension.

|

| (2) |

Subsection (1) of this section—

| (a) |

shall not be inapplicable (notwithstanding the previous operation of subsection (1) of section 27 of this Act (1926 Revised Edition) (Cap. 34 (1926)) (which subsection was repealed by the Widows’ and Orphans’ Pension (Amendment) Act, 1945) (No. 25 of 1945) by reason only of a contributor’s having ceased to contribute before the date of his marriage and before the 1st January, 1944; but

|

| (b) |

shall not apply in respect of any contributor dying before the 8th May, 1942, or, save with the approval of the President, in respect of any contributor who ceased to rank for benefit before the 1st January, 1934.

|

|

| (3) |

No widow of a contributor whose husband dies within twelve calendar months of the marriage without issue of such marriage born in his lifetime, or in due time after his death, shall be capable of constituting a beneficiary or become entitled to any pension under this Act:

Provided that the Crown Agents may, with the approval of the East African Government in which the contributor last served, grant to such widow all or any part of the pension to which she would have been entitled but for the provisions of this subsection.

|

|

| 24. |

Consequence of dismissal for misconduct

Notwithstanding any other provisions of this Act, a contributor who is dismissed from the East African Service or other public service for misconduct shall cease to contribute under this Act, and—

| (a) |

where such contributor is a bachelor, the total amount of his contributions under this Act shall be repaid to him without interest, subject to the deduction of any sums due by him to the Government; and

|

| (b) |

where such contributor is a widower without children of a pensionable age, the total amount of the contributions which he has paid since the death of his last wife or the ceasing to be of a pensionable age of his last child, whichever event last happened, shall be repaid to him without interest, subject to the deduction of any sums due by him to the Government; and

|

| (c) |

where such contributor is married or is a widower with a child of pensionable age, he shall continue to rank for benefit to the extent of such part of the pension registered in his name as his past contributions have earned.

|

|

| 25. |

Pension; when to commence, and how payable

All pensions payable under this Act shall commence upon the death of the contributor in respect of whom they are payable, shall accrue daily and shall be payable monthly in arrear:

Provided that a pension may be payable quarterly instead of monthly if the pensioner so desires.

|

| 26. |

Allowance in lieu of pension to widow on bankruptcy

If a widow’s pension ceases in her lifetime by reason of her bankruptcy, and there are no children of hers to whom such pension can be continued in accordance with subsection (3) of section 20 of this Act, the Crown Agents, with the approval of the East African Government in which the contributor last served, may, from time to time, during the remainder of her life, or during such shorter period or periods, either continuous or discontinuous, as is thought fit, pay to such widow an allowance at a rate not exceeding the rate of such pension, or may apply the same for the maintenance and personal support or benefit of such widow, in such manner as the Crown Agents may, from time to time, think proper.

|

| 27. |

Pension not to be assigned or levied upon

No pension payable under this Act, and no rights of any contributor acquired thereunder, shall be assignable or transferable or liable to be attached, sequestered or levied upon for, or in respect of, any debt or claim whatsoever.

|

| 28. |

Payment of pension in case of desertion of child

If the widow of a contributor, while in receipt of a pension, does not assist or deserts or abandons a child of hers by the contributor whom she is bound by law to maintain and who is of a pensionable age, the Crown Agents may, in their discretion, pay to a fit and proper person on behalf of such child such portion of the pension as they may think fit, and the widow shall have no further claim in respect of such portion.

|

| 29. |

Discretion as to payment of minor’s pension

In all cases where under this Act the parties entitled to pensions are minors, such pensions may be paid, either to the legal guardian or guardians of such minors, or to such minors, or to such person or persons as the Crown Agents may, in their absolute discretion, think fit and proper persons to apply the same for the benefit of such minors, and after such payment the Crown Agents and this Government shall be free from all responsibility in respect of such payment.

|

| 30. |

Proof of title may be required before payment of pension

The Crown Agents may require such proof as they deem desirable that any person claiming to be entitled to pension, or on behalf of whom such claim is made, is alive and entitled to pension, and the payment of any pension may be refused until such proof is furnished to the satisfaction of the Crown Agents.

|

| 31. |

Increases of contributions

Increases of contributions shall rank for the purpose of calculating pensions as if they were fresh entrances at the respective ages of husband and wife when the increase takes place.

|

| 32. |

Contributions may continue in full if salary reduced

If the salary of a contributor is reduced so that he comes under a lower scale of contribution under section 7 of this Act, he may, upon giving notice in writing to the Crown Agents of his desire to do so, continue to contribute at the rate formerly paid, in which case his widow or children shall be entitled to pension accordingly, but if his rate of contribution is reduced any pension to his widow or children shall be reduced in the same proportion as it would have been increased had his rate of contributions been raised instead of lowered.

|

| 33. |

Refund of contributions to bachelor or widower without children

of pensionable age

| (1) |

| (b) |

a widower without children of pensionable age,

|

leaves, or attains the age of fifty-five years while still serving in, or dies in, the East African Service, there shall be payable to him or his legal representative—

| (i) |

if such contributor is a bachelor, the total amount of his contributions together with compound interest thereon calculated with annual rests at the rate of two and one-half per centum, and

|

| (ii) |

if such contributor is a widower without children of a pensionable age, the total amount of contributions which he has paid since the death of his last wife or the ceasing to be of a pensionable age of his last child whichever event shall have last happened, together with compound interest thereon calculated with annual rests at the rate of two and one-half per centum:

|

|

| (i) |

if any such contributor leaves the East African Service and is, without break of service, transferred to other public service in which an approved scheme has been established, he may, at his option exercisable within three months after he ceases to draw salary from this Government, elect not to receive a refund of his contributions with interest thereon as hereinbefore provided; and the total amount to which he would be entitled on such refund shall thereupon remain as part of the funds of the scheme, and, together with an amount representing compound interest calculated as from the date of his transfer with annual rest at the rate of two and one-half per centum, shall— |

|

| (a) |

if the contributor dies or retires from the public service, be paid to him or to his legal representative;

|

| (b) |

if the contributor marries, be taken into account for the purpose of calculating any pension under this Act; or

| (ii) |

if any such contributor who so leaves the East African Service is transferred to any other public service in which no approved scheme has been established, he may, at his option exercisable within three months after he ceases to draw salary from this Government, elect not to receive a refund with interest thereon as hereinbefore provided but to continue to contribute under this Act at the rate at which he was contributing immediately before the left the East African Service; such contributor may at any time thereafter cease to continue his contributions, and in the event of his so ceasing to contribute— |

|

| (a) |

if he is then married or is a widower with children of pensionable age, any pension payable on his death shall be reduced so as to correspond with the payments he has made; and

|

| (b) |

in any other case, the first paragraph of this section shall apply as if he had left the East African Service at the date on which he so ceased to contribute.

|

|

| (2) |

A contributor who has become entitled to a refund of contributions shall cease to rank for benefit by way of pension under this Act.

|

| (3) |

Where a contributor is entitled to elect under this Act not to receive such refund, he shall not become entitled to a refund unless and until the time prescribed for the exercise of the election has expired and the election has not been exercised.

|

|

| 34. |

Option to continue payments

| (1) |

Notwithstanding the provisions of section 33 of this Act, any contributor such as is mentioned in that section—

| (a) |

who is, or has been, compelled, after the 1st January, 1931, to leave the East African Service in consequence of the abolition of his office, or with a view to effecting economy; and

|

| (b) |

who is not transferred to other public service, and

|

| (c) |

who is in receipt of a pension granted in respect of his service in East Africa,

|

may, not later than one month after the date upon which he leaves the East African Service, elect, in lieu of receiving repayment of his contributions under the said section 33, to continue to make contributions, which shall be deducted from his pension, at the rate at which he was contributing immediately before he left the East African Service.

|

| (2) |

The date of the exercise of the option under this section shall be deemed to be the receipt of written notification addressed by the contributor either to the Minister in Kenya or to the Crown Agents.

|

| (3) |

A contributor who has elected under this section to continue to make contributions may, at any time after leaving the East African Service, cease to contribute; and when such a contributor so ceases to contribute then—

| (a) |

if he is married or a widower with children of a pensionable age, any pension payable on his death shall be reduced so as to correspond with the payments he has made;

|

|

| (b) |

in any other case, section 33 of this Act shall apply as if he had left the East African Service at the date on which he so ceased to contribute.

|

|

| 35. |

Contributions repayable in certain cases

If a contributor leaves the East African Service and is transferred to any other public service, and while in such public service becomes a widower, without children of pensionable age, and subsequently retires or otherwise leaves such public service, or dies, there shall be payable to him, or to his legal representative, the total amount of contributions which he has paid since the death of his last wife or the ceasing to be of pensionable age of his last child, whichever event last happened, together with compound interest thereon calculated with annual rests at the rate of two and one-half per centum.

|

| 36. |

Contributor married or widower with pensionable children

leaving East African Service

| (1) |

If a contributor in the service of this Government who is married or who is a widower with children of a pensionable age and whose period of payment of contribution has not expired—

| (a) |

is transferred to other public service, not being East African Service; or

|

| (b) |

being an officer who became a contributor before the 1st January, 1944, otherwise leaves the East African Service, except on retirement on pension, and his service is of such a nature and of such length as would have rendered him eligible for a pension if he had been retired from the East African Service on medical certificate,

|

he may continue to contribute at the rate at which he was contributing immediately before he left the East African Service; he may, on or at any time after so leaving the East African Service, cease to contribute, and, if he so ceases to contribute, any pension payable on his death shall be reduced so as to correspond with the payments he has made.

|

| (2) |

If a contributor under this Act is appointed to the service of another East African Government, and he is not in receipt of salary from this Government, he shall cease to contribute under this Act as from the date of such appointment

|

|

| 37. |

Option to contributor retiring on pension to cease or continue

contributing

| (1) |

If a contributor who is married or who is a widower with children of a pensionable age and whose period of payment of contributions has not expired retires on pension from the East African Service or from other public service, and at such date was contributing under this Act, he shall continue to contribute at the rate at which he was contributing immediately before the date of his retirement:

Provided that—

|

| (i) |

any such contributor in lieu of so contributing may, at any time, elect at his option either— and in the event of his exercising his option the amount of the pension registered in his name shall be adjusted accordingly; |

| (ii) |

should any such contributor after the date of his retirement become a widower without children of a pensionable age, he shall forthwith cease to contribute and shall cease to be entitled to rank for the benefit under this Act either by way of pension or return of contributions. |

| (2) |

Where any such contributor who has elected under paragraph (a) of the first proviso to subsection (1) of this section to cease contributing under this Act dies within two years of his retirement on pension on the grounds of ill-health, the full pension registered in his name on the day immediately preceding his retirement shall be payable, subject to the other provisions of this Act.

|

| (3) |

Where any such contributor who has elected under paragraph (b) of the first proviso to subsection (1) of this section to pay contributions assessed on his pension dies within three years of the date of his retirement on pension on the grounds of ill-health, the full pension registered in his name under this Act on the

day immediately preceding his retirement shall be payable, subject to the other provisions of this Act.

|

| (5) |

Where an officer has elected or been compelled to receive a reduced pension and gratuity, in lieu of pension which he might have received but for such election or compulsion, his pension shall, for the purpose of calculating his contributions under paragraph (b) of the first proviso to subsection (1) of this section, be deemed to be the amount of the unreduced pension which he might have so received.

|

|

| 38. |

Pension payable when pensionable officer retires on account

of ill-health and dies within two years

If a contributor who is married or who is a widower with children of pensionable age and who has not served the period necessary to qualify him for pension but who is otherwise eligible therefor retires from the East African Service or other public service on a medical certificate before his period of contribution has expired, ceases to contribute and dies within two years of the date of his retirement, the full pension registered in his name on the date immediately preceding his retirement shall be payable subject to the other provisions of this Act.

|

| 39. |

Registered pension in case of non-pensionable officer leaving

service

| (1) |

A contributor who is married or who is a widower with children of a pensionable age and—

| (a) |

whose service is not of such a nature or is not of such length as would render him eligible for a pension if retired from the East African Service on a medical certificate and who retires from the East African Service or other public service; or

|

| (b) |

whose service is of such a nature and of such length as would have rendered him eligible for pension if he had retired from the East African Service on a medical certificate and who, being an officer who became a contributor under this Act on or after the 1st January, 1944, retires from the East African Service otherwise than on pension,

|

shall have registered in his name the pension actually earned by his past contributions and shall not be eligible to continue to contribute after the date of his retirement:

Provided that—

| (i) |

any such contributor may at his option exercisable as hereinafter provided in lieu of having registered such pension elect to have registered the full pension which was registered in his name at the date of his retirement for a period commencing from such date and equal to one-half of the period during which he contributed under this Act, and, if he is alive on the expiration of the above-mentioned period during which he was entitled to rank for benefit under the scheme, he shall cease to be entitled to rank for benefit whether by way of pension or return of contributions; and |

| (ii) |

where any such contributor who has exercised his option and elected under the first proviso to this subsection to have the full pension registered in his name is appointed or reappointed to the service of this Government before the expiration of the period for which the full pension is registered as aforesaid, he shall as from the date of his appointment or reappointment commence or recommence to pay contributions under this Act or if he so elects within three months of his appointment or reappointment as from the expiration of the said period. |

|

|

| (2) |

(a) The option referred to in the first proviso to subsection (1) of this section shall be exercisable not later than three months after the date on which the contributor ceases to draw salary.

|

| (b) |

The date of the exercise of the option under this section shall be deemed to be the date of the receipt of the officer’s written notification addressed either to the Permanent Secretary to the Treasury in Kenya or to the Crown Agents.

|

|

|

| 40. |

Periodic revision of pension tablets

| (1) |

The pension tables may be revised from time to time after an investigation by an actuary appointed by the President.

|

| (2) |

Such investigations shall take place at such dates as the President may from time to time determine, being not more than ten years from the date when the scheme first came into operation or from the date of the last investigation.

|

| (3) |

If after such an investigation it is decided by the President that revised pension tables shall be adopted, the new pension tables and instructions for their use as approved by the actuary shall be substituted for the tables and instructions previously in force and shall come into force on a date to be appointed by the President by notice in the Gazette, and shall apply to any pension payable in respect of a contributor dying on or after that date, but not to any pension payable in respect of a contributor dying before that date.

|

|

| 41. |

Questions to be decided by President

All questions and disputes as to who is entitled to be deemed a contributor, or as to the right of a widow or child to a pension, or as to the amount of such pension, or as to the rights or liabilities of any person under this Act, shall be referred by the Crown Agents to the East African Government in which the European officer concerned is serving or last served, and the decision of the President shall be binding and conclusive on all parties, and shall be final to all intents and purposes and shall not be subject to appeal or be questioned or revised by any court of justice.

|

| 42. |

Cost of management of scheme

This Government shall bear such proportion as the President may from time to time determine of the cost of the management of the scheme, including the amount of any expenditure incurred by the directions of the President for actuarial advice or investigations in connection with the scheme.

|

| 43. |

Rules and regulations

The President may make rules and regulations not inconsistent herewith for the proper carrying out of the provisions of this Act.

|

| 44. |

Notices of election irrevocable

Unless otherwise provided by this Act, all notices of election given by officers under this Act shall be irrevocable.

|

| 45. |

Rates of exchange

For the payment of contributions or of pensions under this Act, the rate or rates of exchange, in all cases where conversion is necessary from sterling to any other currency, shall be such as may be fixed from time to time by this Government for such purposes.

|

| 46. |

Officers on war service

| (1) |

Where an officer is on leave from the service of this Government for the purpose of serving with Her Majesty’s Forces in time of war, or in consequence of having so served, then, notwithstanding anything contained in this Act, his salary shall for the purpose of computing his contributions under this Act be deemed to be the salary which he would have received had he remained on duty in his substantive office.

|

| (2) |

Where an officer, with the approval of the President, has left the service of this Government for the purpose aforesaid, then, notwithstanding anything contained in this Act, so long as it is the expressed intention of this Government and of the officer that he should, as soon as practicable after the termination of his service with Her Majesty’s Forces, return to the service of this Government, he may, by electing in such manner and within such time as may be directed by the President, continue to contribute; and if he so elects his salary shall, for the purpose of computing his contributions, be deemed to be the salary which he would have received, with all increments for which he would have been eligible, if he had continued to hold the substantive office held by him immediately before so leaving the service of this Government:

Provided that—

| (i) |

if and so long as the officer is in receipt from the funds of this Government of payment in the nature of salary or other emoluments equivalent to, or greater than, the contributions which would be due from him if he elected under this subsection to continue to contribute, he shall continue to contribute as aforesaid whether he does or does not elect so to do; and |

| (ii) |

where and so long as the provisions of this subsection relating to the return of the officer to the service of this Government are inapplicable by reason only of a proposal that such officer should be appointed to other service under the Crown, this subsection shall continue to apply to him until he is so appointed; and when he is so appointed he shall be deemed, for the purposes of this Act, to have been transferred to such other service. |

|

| (3) |

Where, in any case to which subsection (1) or subsection (2) of this section applies, payment is being made from the funds of this Government to the officer in the nature of salary or other emoluments, his contributions may be deducted from the sums so payable; and where no such payment is being made, or if the contributions of the officer exceed such payments, the contributions or the balance thereof, as the case may be, shall be paid by the officer.

|

| (4) |

If any officer who is entitled, under subsection (2) of this section, to elect to continue to contribute does not duly so elect, or if any officer fails to pay when due

any sum payable by him under subsection (3) of this section, the President may give either or both of the following directions, that is to say—

| (a) |

that the officer shall cease to contribute as from a date (which may be before the date of the direction) to be specified in the direction; and

|

| (b) |

that the Pensions (War Service) Act, 1940 (No. 21 of 1940), shall not apply to his case,

|

and any such direction shall have the force of law.

|

| (5) |

This section, notwithstanding anything contained therein, shall not apply where the office in the service of this Government last held by the officer before service in Her Majesty’s Forces was not a pensionable office for the purposes of the Pensions Act (Cap. 189) except where in any particular case the President otherwise directs.

|

|

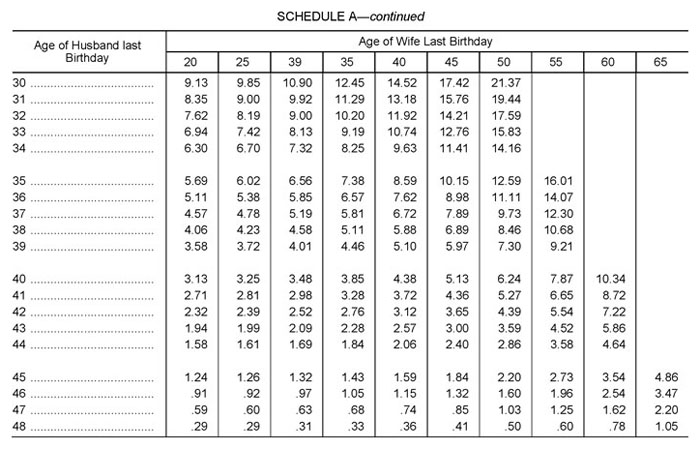

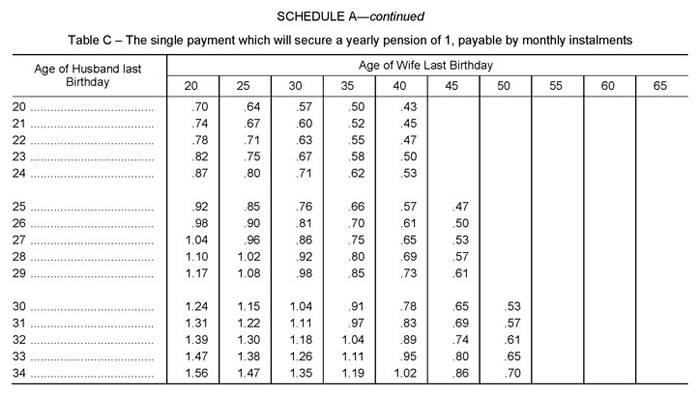

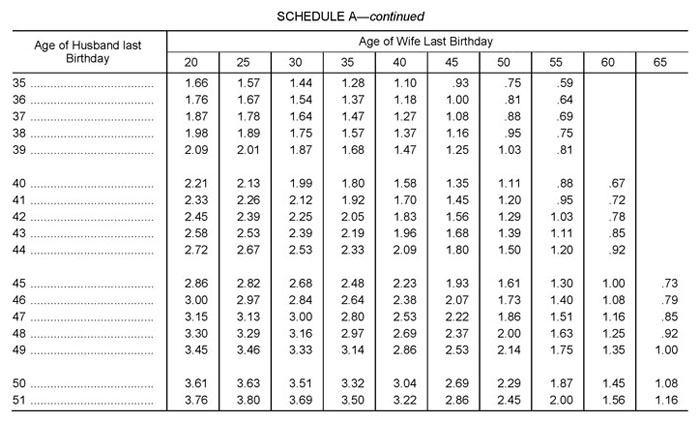

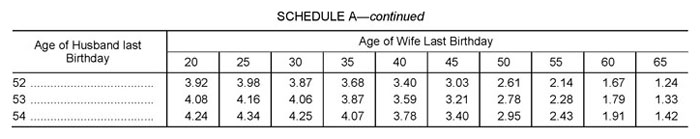

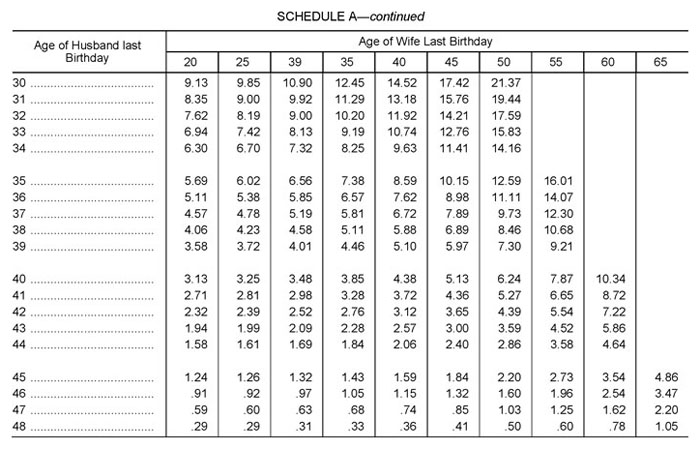

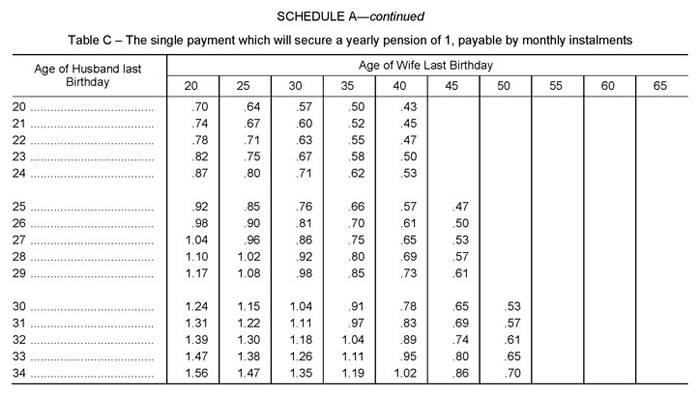

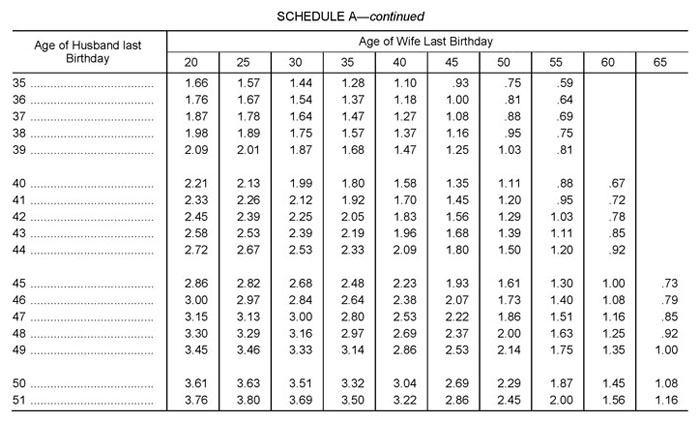

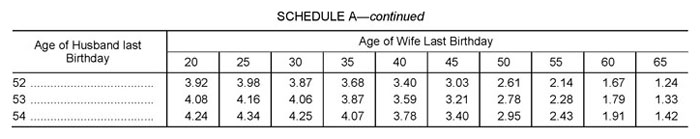

SCHEDULE A [Section 19, Act No. 9 of 1960, s. 12, Act No.

17 of 1964, s. 2.]

PENSION TABLES

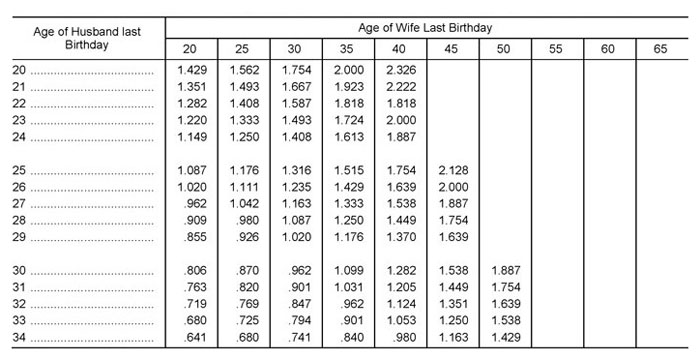

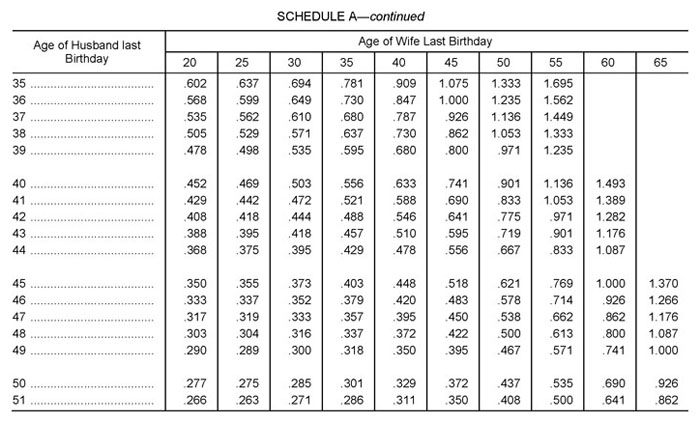

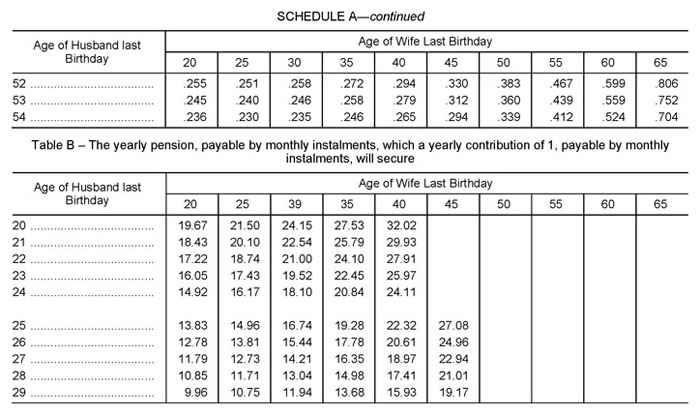

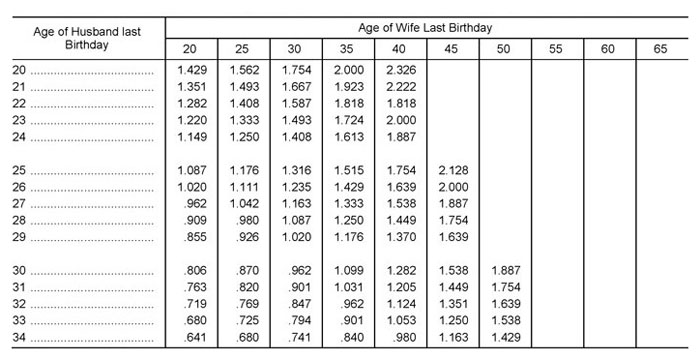

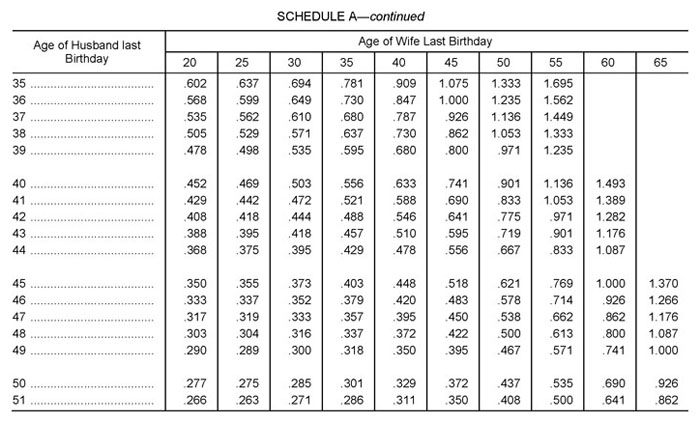

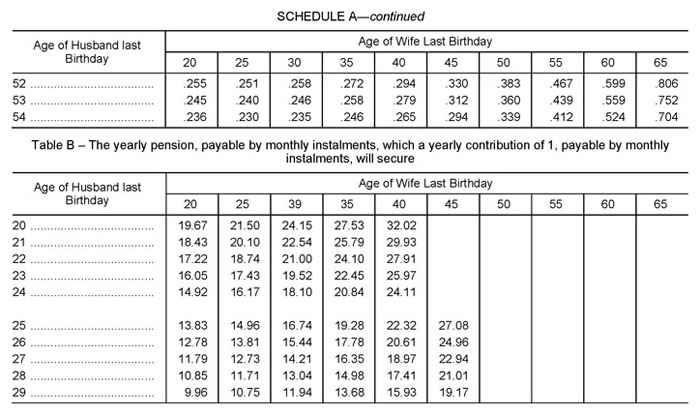

Table A — The yearly pension, payable by monthly instalments, which are single payment of 1 will secure

SCHEDULE B [Section 19, Act No. 9 of 1960, Section 12, Act

No. 17 of 1964, Section 2.]

INSTRUCTION FOR THE USE OF THE TABLES IN SCHEDULE A

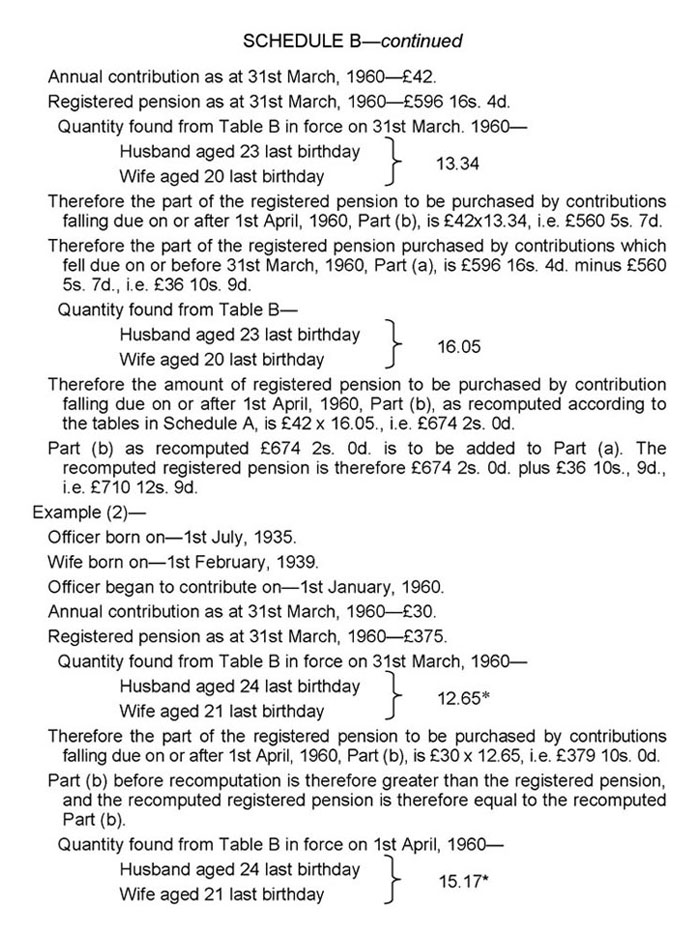

Note.—(1). The registered pension in respect of every married or widowed officer who ceased to contribute before 1st April, 1960, shall continue to be computed on the tables and instructions in force on 31st March, 1960.

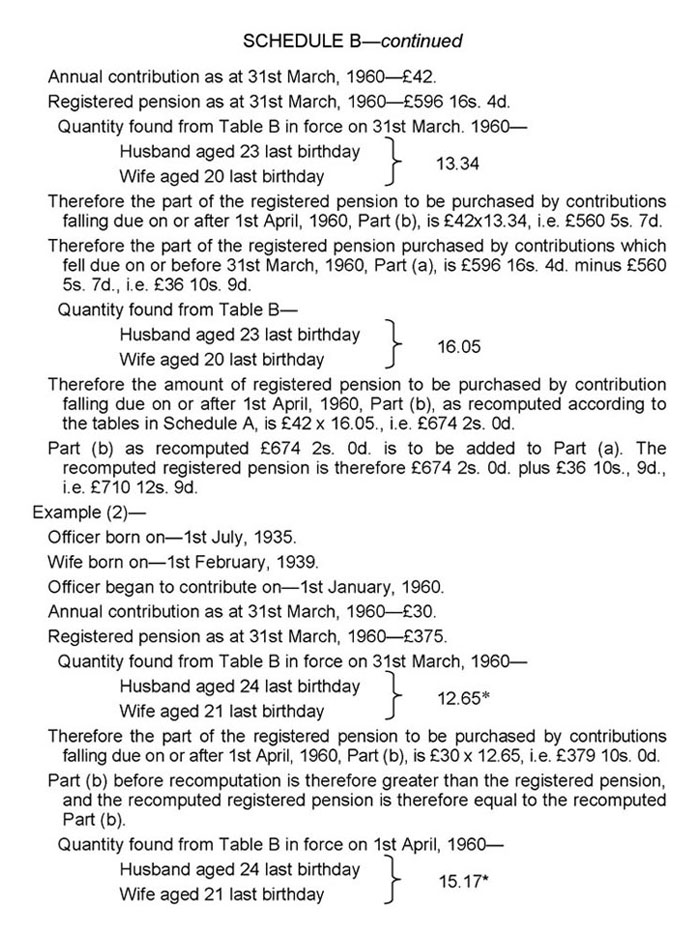

Note.—(2). The pension as at 1st April, 1960 (“the original pension”) computed on the tables and instructions in force on 31st March, 1960, and registered in respect of each married or widowed officer who began to contribute before, and was still contributing on 1st April, 1960, shall be recomputed as follows—

| (i) |

The original pension shall be divided into two parts—

| (a) |

the part purchased by contributions which fell due on or before 31st March, 1960; and

|

| (b) |

the part to be purchased by contributions falling due on or after 1st April, 1960.

|

|

| (ii) |

Part (b) shall be recomputed by applying to Table B in Schedule A the amount of annual contribution as at 1st April, 1960.

|

| (iii) |

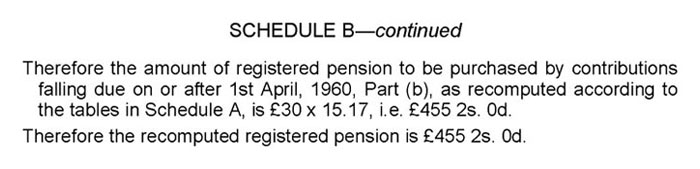

The registered pension at 1st April, 1960, shall be obtained by adding the recomputation is greater than the original pension, the recomputed Part (b) to Part (a), except that if Part (b) before the recomputed pension shall be equal to the recomputed Part (b). (For examples see Part G of this Schedule.)

|

Note.—(3). The tables and instructions in Schedule A shall apply—

| (i) |

to all pensions registered in respect of officers who began to contribute on or after 1st April, 1960;

|

| (ii) |

to all pensions registered in respect of officers who were contributing on 1st April, 1960, for the purpose of computing variations when their rates of contribution rise or fall on or after that date;

|

| (iii) |

to all pensions registered on marriage in respect of bachelors who marry on or after 1st April, 1960, in relation to contributions paid both before and after marriage; and

|

| (iv) |

to all pensions registered in respect of widowers, for the purpose of computing variations if they remarry on or after 1st April, 1960.

|

A.—CONTRIBUTOR WHO BEGAN TO CONTRIBUTE WHILE A BACHELOR

I.—First Wife’s Prospective Pension

The registered pension to be recorded on marriage is found by adding together the two amounts calculated in accordance with the following Rules—

If the contributor began to contribute on or after 1st July, 1936- apply Rule I(a)(1) and Rule I(b).

If the contributor began to contribute before 1st July, 1936-apply Rule I(a)(2) and Rule I(b).

(a) Pension in consideration of the contributions paid during bachelorhood

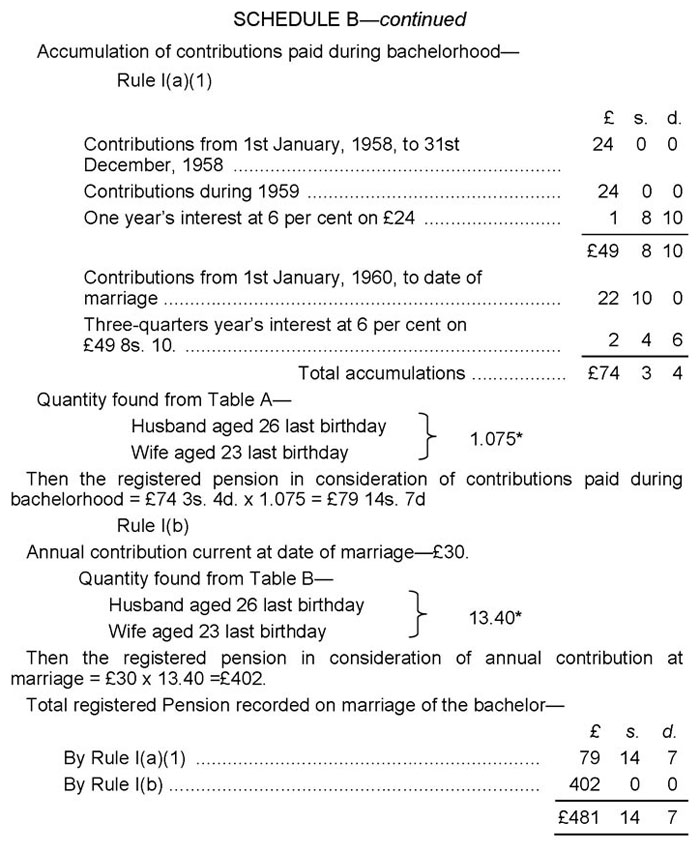

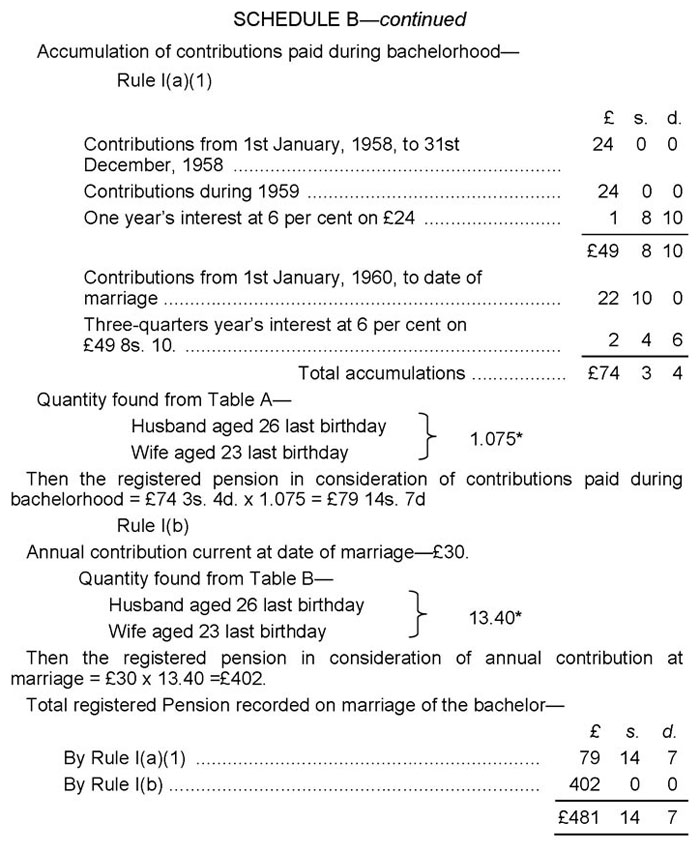

Rule I(a)(1).—For contributors who began to contribute on 1st July, 1936, or later, accumulate the contributions at 6 per cent compound interest with yearly rests at each 31st December, and multiply the result by the quantity found from Table A corresponding to the respective ages last birthday of the husband and wife at the date of marriage.

The product give the registered pension on account of the contributions paid during bachelorhood.

Rule I(a)(2).—For contributors who began to contribute prior to 1st July, 1936, accumulate the contributions at 8 per cent compound interest with yearly rests at each 31st December up to 31st December, 1935. Add simple interest at 8 per cent per annum up to 30th June, 1936, Add simple interest at 6 per cent per annum on the accumulated contributions thus obtained to 31st December, 1936. Accumulate thereafter at 6 per cent compound interest with yearly rests at each 31st December, and multiply the result by the quantity found from Table A corresponding to the respective ages last birthday of the husband and wife at the date of marriage (as at Rule I(a)(I) above). The product gives the registered pension on account of the contribution paid during bachelorhood.

(b) Pension in consideration of the annual contribution at the date of marriage

Rule I(b).—Multiply the amount of the annual contribution by the quantity found from Table B corresponding to the respective ages last birthday of the husband and wife at the date of marriage.

The product gives the registered pension on account of the annual contribution at the date of marriage.

Example—

Officer born on—4th May, 1934.

Officer began to contribute on—1st January, 1958.

Officer married on—30th September, 1960.

Wife born on—5th September, 1937.

Officer ’s age last birthday at date of marriage—26.

Wife ’s age last birthday at date of marriage—23.

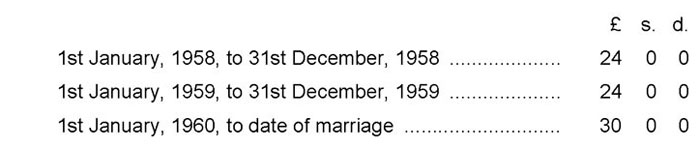

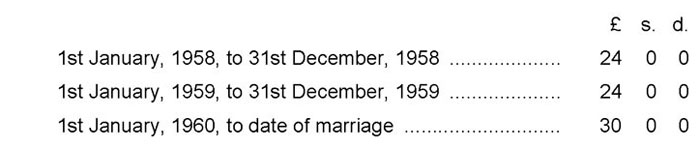

Annual contributions—

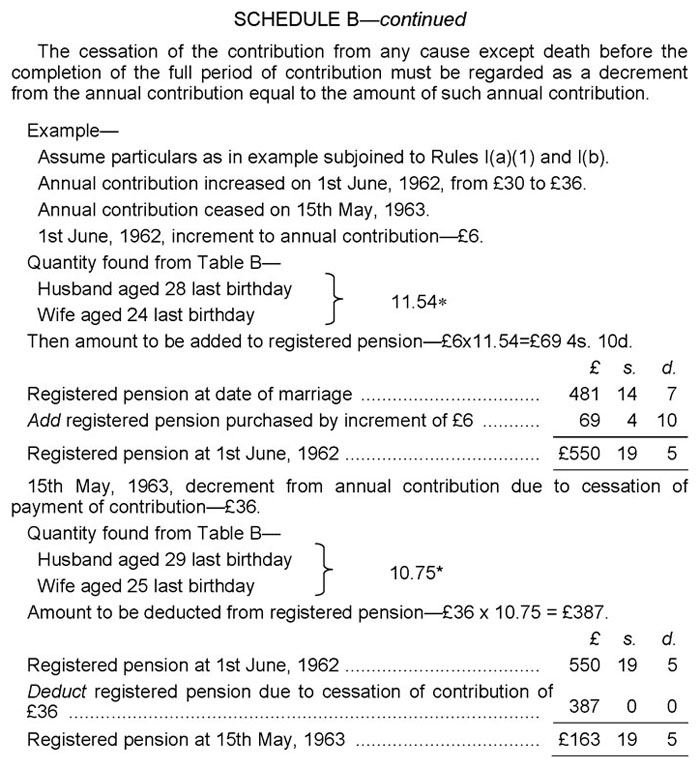

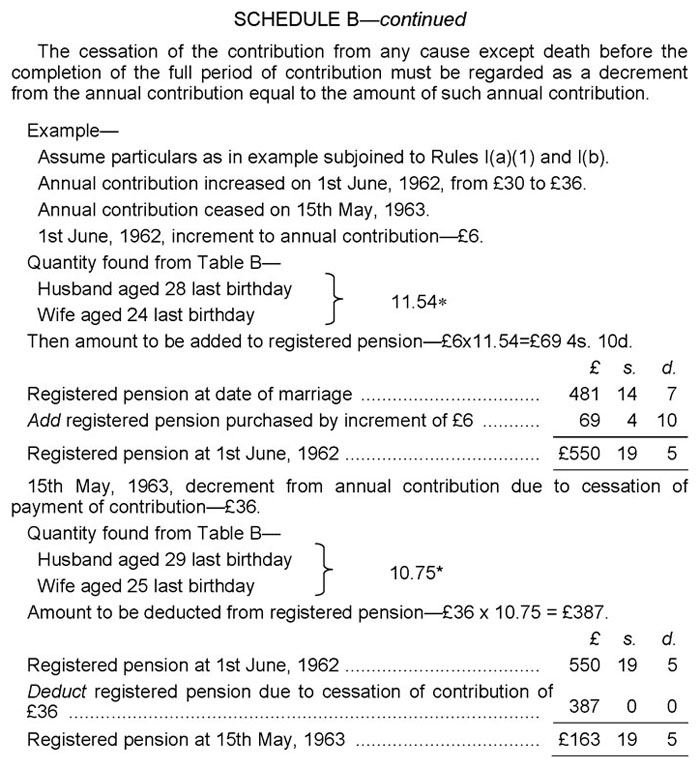

(c) Variations of pension consequent on increments to, and decrements from, the annual contribution while the contributor is married to his first wife

Rule I(c).—Multiply the amount of the increment to, or the decrement from, the annual contribution by the quantity found from Table B corresponding to the respective ages last birthday of the husband and wife at the date of the variation of the contribution.

The product gives the amount to be added to the registered pension consequent on the increment to the annual contributions, or, as the case may be, the amount to be deducted from the registered pension consequent on the decrement from the annual contribution.

Second and Subsequent Wife’s Prospective Pension

(a) Variations of pension consequent on increments to, and decrements from, the annual contribution while the contributor is a widower

Rule II(a).—Assume that the contributor is married to a wife of the age that his last preceding wife would have been had she survived to the date of the variation of the contribution, and proceed in accordance with Rule I(c).

Example of the application of Rule II(a)—

If the particulars are as in the example subjoined to Rule I(c) except that the first wife, who was born on 5th September, 1937, died on 7th June, 1961, it will be assumed that the contributor was, at the date of each of the two variations of the contribution, married to a wife who was born on 5th September, 1937. The calculations will then be identical with those given in the example subjoined to Rule I(c).

_________________________________

*See F which gives the method of calculation of quantities not immediately available from the Tables.

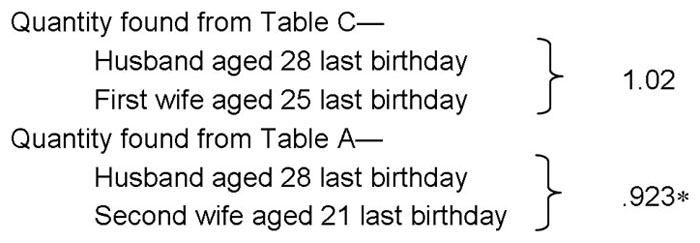

(b) Variations of pension consequent on the remarriage of the contributor

If the second or subsequent wife was, at the date of the remarriage, of the same age last birthday as the last preceding wife would have been had she survived, the registered pension remains the same.

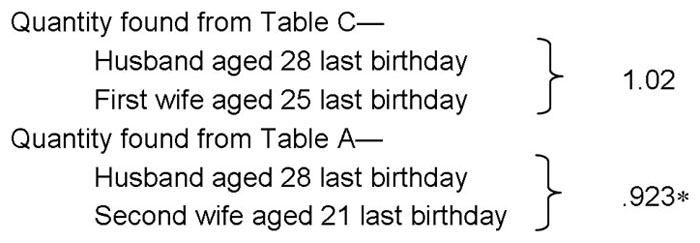

Rule II(b).—If the second or subsequent wife is younger or older than the last preceding wife would have been had she survived, multiply the amount of the registered pension by the quantity found from Table C corresponding to the age last birthday of the husband at the date of remarriage, and the age last birthday, which the last preceding wife would have attained had she survived to that date; multiply the product so obtained by the quantity found from Table A corresponding to the respective ages last birthday of the husband and of the second or subsequent wife at the date of the remarriage.

The result gives the registered pension to be recorded on the remarriage of the contributor.

Example—

Assume particulars as in the example subjoined to Rule I(c).

First Wife died on—7th June, 1961.

Contributor remarried on—11th September, 1962.

Contributor ’s age last birthday at date of remarriage—28.

Second wife born on—30th April, 1941.

Second wife’s age last birthday at date of remarriage—21.

Age last birthday which the first wife would have attained had she survived to the date of the remarriage—25.

11th September, 1962.—The second wife being younger than the first wife would have been had she survived, the registered pension of £550 19s. 5d. (see example subjoined to Rule I(c) has to be recalculated.

Registered pension at 11th September, 1962 = £550 19s. 5d.x 1.02 x 923 = £518 14s. 4d.

_________________________________

*See F which gives the method of calculation of quantities not immediately available from the Tables.

SCHEDULE B-continued

(c) Variations of pension consequent on increments to, and decrements from, the annual contribution while the contributor is married to his second or subsequent wife

Rule II(c).—Proceed as in Rule I(c).

B.—CONTRIBUTOR WHO BEGAN TO CONTRIBUTE WHILE MARRIED

III.—First Wife’s Prospective Pension

Where an officer began to contribute while married, the wife at the date of commencement of contributions is to be considered as the officer’s first wife, and no particulars are to be recorded respecting any former wife unless there was issue of pensionable age of such former wife (see C-Rule V).

(a) Pension in consideration of the annual contribution at the date of commencement of contributions

Rule III(a).—Multiply the amount of the annual contribution by the quantity found from Table B corresponding to the respective ages last birthday of the husband and wife at the date of commencement of contributions.

The product gives the registered pension on account of the annual contribution at the date of commencement of contributions.

Example—

Officer born on—2nd May, 1933.

Officer married on—15th April, 1959.

Officer began to contribute on—1st October, 1960.

Annual contribution on 1st October, 1960—£36.

Wife born on—4th February, 1935.

Officer ’s age last birthday on 1st October, 1960—27.

Wife ’s age last birthday on 1st October, 1960—25.

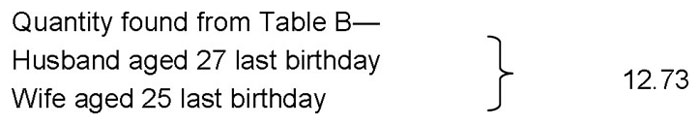

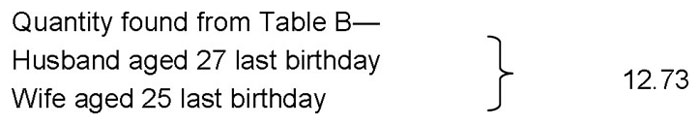

Quantity found from Table B—

Registered pension in consideration of annual contribution at commencement of contributions = £36 x 12.73 = £458 5s. 7d

(b) Variations of pension consequent on increments to, and decrements from, the annual contribution while the contributor is married to his first wife.

Rule III(b).—Proceed as in Rule I(c).

IV.—Second and Subsequent Wife’s Prospective Pension

(a) Variations of pension consequent on increments to, and decrements from, the annual contribution while the contributor is a widower

Rule IV(a).—Proceed as in Rule II(a).

SCHEDULE B-continued

(b) Variations of pension consequent on the remarriage of the contributor

Rule IV(b).—Proceed as in Rule II(b).

(c) Variations of pension consequent on increments to, and decrements from, the annual contribution while the contributor is married to his second or subsequent wife

Rule IV(c).—Proceed as in Rule I(c).

C.—CONTRIBUTOR WHO BEGAN TO CONTRIBUTE WHILE A WIDOWER

V.—Prospective Pension to Children by His First Marriage

So long as a contributor’s children by his first marriage are eligible for pension, a pension must be registered on their behalf. If there are no such children, the widower should be treated as if he were a bachelor.

Rule V.—For the purpose of calculating the registered pension of the children, assume that the deceased wife lived until the date of commencement of contributions and died immediately afterwards, and proceed in accordance with Rules III(a) and IV(a).

VI.—Second and Subsequent Wife’s Prospective Pension

Rule VI.—For the purpose of calculating the registered pension of the wife, assume that the deceased wife survived to the date of commencement of contributions and died immediately afterwards; then proceed in accordance with rules applicable to the case of officers who began to contribute while married (see B).

D.—CONTRIBUTOR WITH TWO OR MORE BENEFICIARIES